Everything you need to know about moving to Managed Payroll

Payroll UK Payroll Processing Guide for Tax Year 2023-2024: Key Changes and DatesLegislation & Compliance

UK Payroll Processing Guide for Tax Year 2023-2024: Key Changes and DatesLegislation & Compliance Your guide to integrated Payroll and HR software systemsPayroll

Your guide to integrated Payroll and HR software systemsPayroll How can AI help with payroll, now and in the future?The Payroll Navigator 2024

How can AI help with payroll, now and in the future?The Payroll Navigator 2024

Technology in the workplace; what happens when it’s the focus?

Technology in the workplace is not a new phenomenon but a continuous drive towards automation which has been taking place to varying degrees since the rise of Manchester Capitalism and the Industrial Revolution. As such, there is much we can learn from history regarding the nature of work.

Say goodbye to payroll pitfalls: Going global in 2017

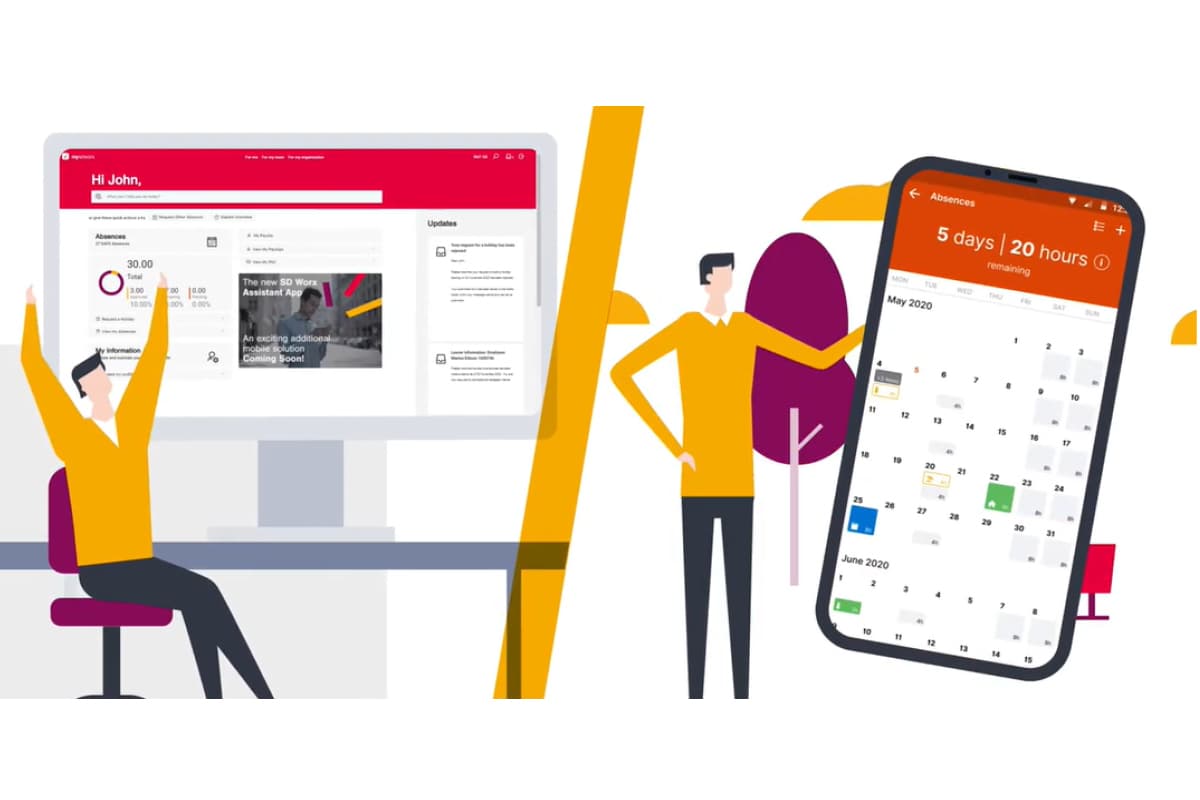

As the business world becomes ever more disparate and global, it comes as no surprise that managing payroll across multiple markets is presenting more challenges than ever before. To delve into the issues at hand, our SD Worx Global solution and services team recently conducted pan-European research to gauge a better understanding of the key payroll challenges impacting modern multinationals, as well as the changes that industry professionals want to see in the New Year.

The Rise of the Robots

As we have seen in the news this week robotics and AI are quickly becoming a real thing in both business and the home. In the next few years we will see more and more of this type of technology taking on more and more of the administrative type roles in businesses around the world. In this blog, I share my thoughts on this trend and some of my very own personal experiences…

Don’t work harder, work smarter: Why 2017 will be the year of global payroll

2016 has been an eventful year, with lots of social and political change occurring around the world. Change, of course, can be a great thing – it can bring new perspective and a fresh outlook, something which also holds true in the context of business and HR.

Four payroll plans to focus on in 2017

Payroll is a standard pillar that all businesses need to get right in order to avoid inefficiency and increased costs. Despite this, many organisations are still working with outdated and ineffective payroll systems that eat into valuable HR time, and business profit. As part of our four-part New Years’ Resolution content series, which will run over the coming weeks, our first blog looks at how to avoid key payroll pitfalls and ensure better communication when it comes to the costs involved. So, if you’re a payroll or HR professional with a plan to streamline costs and processes in 2017 but don’t know where to begin, here are four key things to help you get the New Year off to a good start…

Prepared & Proactive? HR & its Role in the Future of Work

Never before has it been more vital for businesses to optimise the ideas, strengths and skills of their entire workforce – and of others within their industry and beyond.

Why it’s time for payroll to get into analytics

Step back in time five years and you would struggle to move for articles and white papers on big data and analytics. These were the hottest topics in technology and the excitement surrounding them was at its peak. Last year, analyst Gartner dropped its hype cycle for Big Data, confirming in an article, entitled: The Demise of Big Data, Its Lessons and the State of Things to Come” that “we did it to move the big data discussion past hype and into practice”. Certainly when it comes to the HR arena, big data and the analytics tools that can be built on top of it are now in a maturing phase.

Serious threat to Cash or Benefit arrangements

In August 2016, HMRC launched a ‘Consultation on salary sacrifice for the provision of benefits in kind’. The indication is to bring in law changes from April 2017.

What is the impact of an acquisition on my existing contract?

Often once the deal is done you can’t see the lawyers for dust, so if you receive notice from a supplier or customer that they have been acquired, or if you have been acquired yourself, what do you need to do to keep your current contracts in order?

Navigating the Brexit challenge; HR Strategies to Stay in Control

For the world of business and more specifically HR, the Brexit vote has brought on a time of uncertainty. The momentous decision taken by the public on June 23 has left employers across the UK having to wrestle with a vast range of workforce-related issues.

Apprenticeship Levy: Are You Preparing?

The 6th April 2017 sees the introduction of a new employment tax on United Kingdom employers. The way the government funds apprenticeships in England is changing, and Scotland Wales and Northern Ireland, each having their share of the levy, will have to decide how apprenticeship spending will take place.

National Insurance, New Starters, & Irregular payment after leaving

So the UK (as a union) has voted to leave the European Union with some Scottish politicians hinting of a further independence referendum, and some in Northern Ireland wanting a joint Irish nation! At the same time, Job Centre Plus has run out of National Insurance numbers (NINOs) and decided in June 2016 to start issuing NINOs with prefix ‘KC’.