Everything you need to know about moving to Managed Payroll

Payroll UK Payroll Processing Guide for Tax Year 2023-2024: Key Changes and DatesLegislation & Compliance

UK Payroll Processing Guide for Tax Year 2023-2024: Key Changes and DatesLegislation & Compliance Your guide to integrated Payroll and HR software systemsPayroll

Your guide to integrated Payroll and HR software systemsPayroll How can AI help with payroll, now and in the future?The Payroll Navigator 2024

How can AI help with payroll, now and in the future?The Payroll Navigator 2024

Revealing the hidden costs of in-house payroll

Many businesses remain unaware of the benefits of outsourcing payroll. Finance and payroll managers often believe that an in-house team, or one person doing everything, cuts costs and retains control. In reality, it’s likely to end up costing more, slow digital transformation and impact business continuity.

It's time for finance leaders to get serious about payroll

The role of the modern finance leader is much more than just assessing financial performance and monitoring cashflow. Nowadays, a good financial leader takes stock of the whole organisation to make sure every aspect is aligned to business goals.

Payroll fraud costs UK businesses £12 billion a year – here’s how to stop it

When it comes to types of fraud, we’re all familiar with insurance, tax and even identity theft, but payroll fraud is often swept under the rug. It’s not one to be ignored, as every year it costs UK businesses £12 billion in loss.

Why more CFOs are turning to outsourcing post-covid

The impact of the global coronavirus pandemic has forced finance leaders to do the impossible; maintain stability in a chaotic environment.

Furlough advice: Debunking salary sacrifice and benefits in kind myths

Many UK businesses furloughed their employees to keep paying workers while business was temporarily closed under The Coronavirus Job Retention Scheme (CJRS). The government’s measure helped thousands of businesses to stay afloat, but one issue that continues to perplex people is in relation to employee benefits and salary sacrifice arrangements, such as childcare vouchers and cycle-to-work schemes.

Everything you need to know about the Government’s £2 billion Kickstart scheme

As part of the government’s Plan for Jobs, a new £2 billion Kickstart Scheme is set to create hundreds of thousands of new, fully subsidised jobs for young people across the country.

National Payroll Week 2020

Launching on the 7th September 2020, National Payroll Week is raising awareness of the impact of payroll and celebrating the hard-working payroll pioneers who keep the UK paid.

5 things to consider when assessing your payroll maturity

How has your payroll operation performed over the last few months? Has it remained a strong and resilient, or has it crumbled under the pressures of the pandemic? Whatever your answer, the origin is often the maturity of your payroll operation.

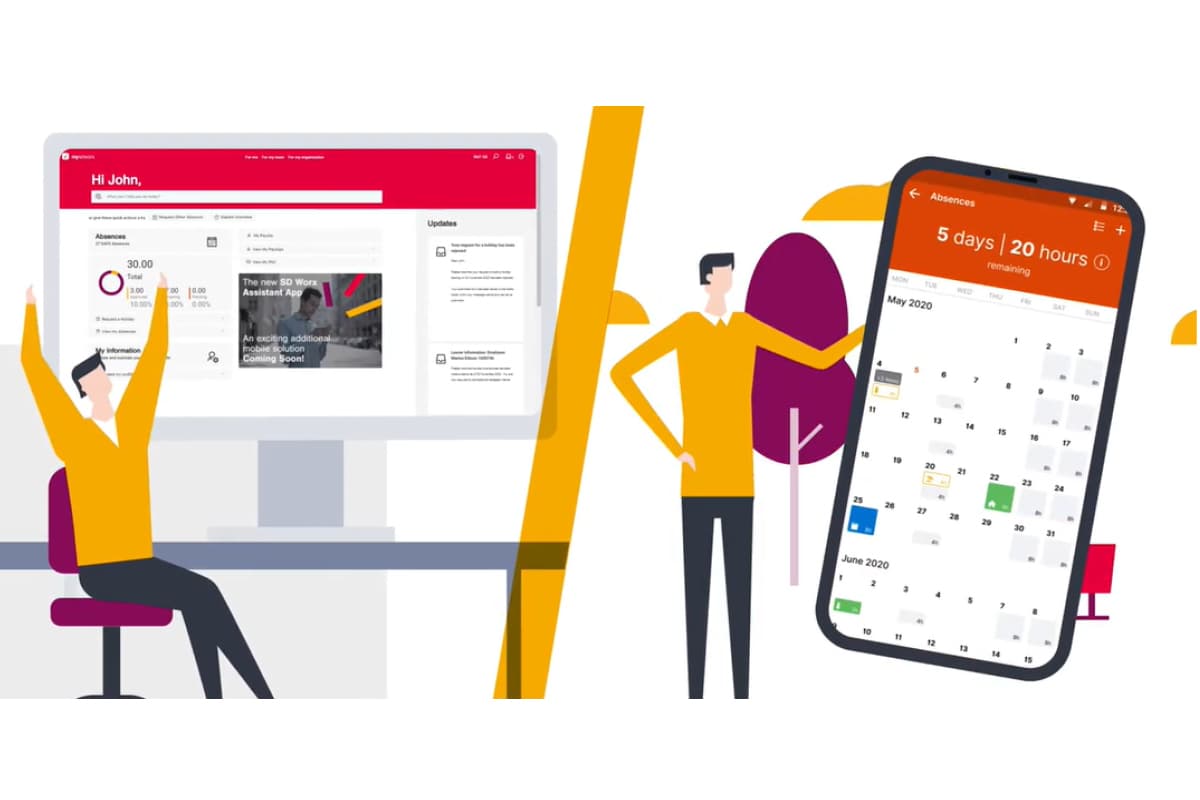

7 ways a workforce management solution adds value to your organisation

Working smarter, becoming more efficient and driving cost savings are top of the list for most organisations, but many haven’t uncovered the missing link in their strategy: workforce management.

5 things people get wrong about HR

Over the years, I’ve heard many inaccurate, and often amusing, assumptions of what working in HR is like from outside perspectives. One being, “HR sounds like an easy number they just hire and fire people” Fellow HR leaders, does this sound familiar?

How HR can enable organisational success beyond Covid-19

Last week I joined Kevin Green, ex HR Director of Royal Mail and Chair Advisory Board at Circal, to discuss how organisations have responded to the Covid-19 pandemic and HR’s role within that response. Don’t worry if you missed the webinar, you can watch the full version here.

6 reasons your HR and payroll struggled through Covid-19

It’s fair to say that HR and Payroll teams have been tested as the Covid-19 pandemic unfolded. But after several months of firefighting, many organisations recognise that they need to make significant changes to their payroll and HR operations.